Whether you’re an owner-operator looking to upgrade your rig or a budding entrepreneur looking to get into the trucking industry, the first step is always to understand the basics of commercial truck financing and refinancing.

This comprehensive guide will walk you through the essential steps of dealing with commercial truck financing and everything in between!

1. Finding Your Truck

Before diving into the financing process, it may be helpful to narrow down the specific truck and price of the truck you want to purchase. Having more information about the truck can help round out your loan application and expedite it.

Brand New vs. Used: Brand new trucks offer the latest technology and are covered by longer warranties, but they come with a higher price tag. Used trucks may be more budget-friendly but will have a shorter warranty period and require careful inspection to ensure they meet safety and performance standards.

Amenities: Depending on your business requirements, you may require different amenities of the truck. Some truckers prioritize comfort features for long hauls, such as sleeper cabs, while others focus on fuel efficiency and payload capacity.

Budget: Establish a realistic budget by considering not only the upfront cost of the truck but also ongoing expenses such as maintenance, insurance, and fuel. This will be crucial when determining the financing amount you need and not financing more than you can afford.

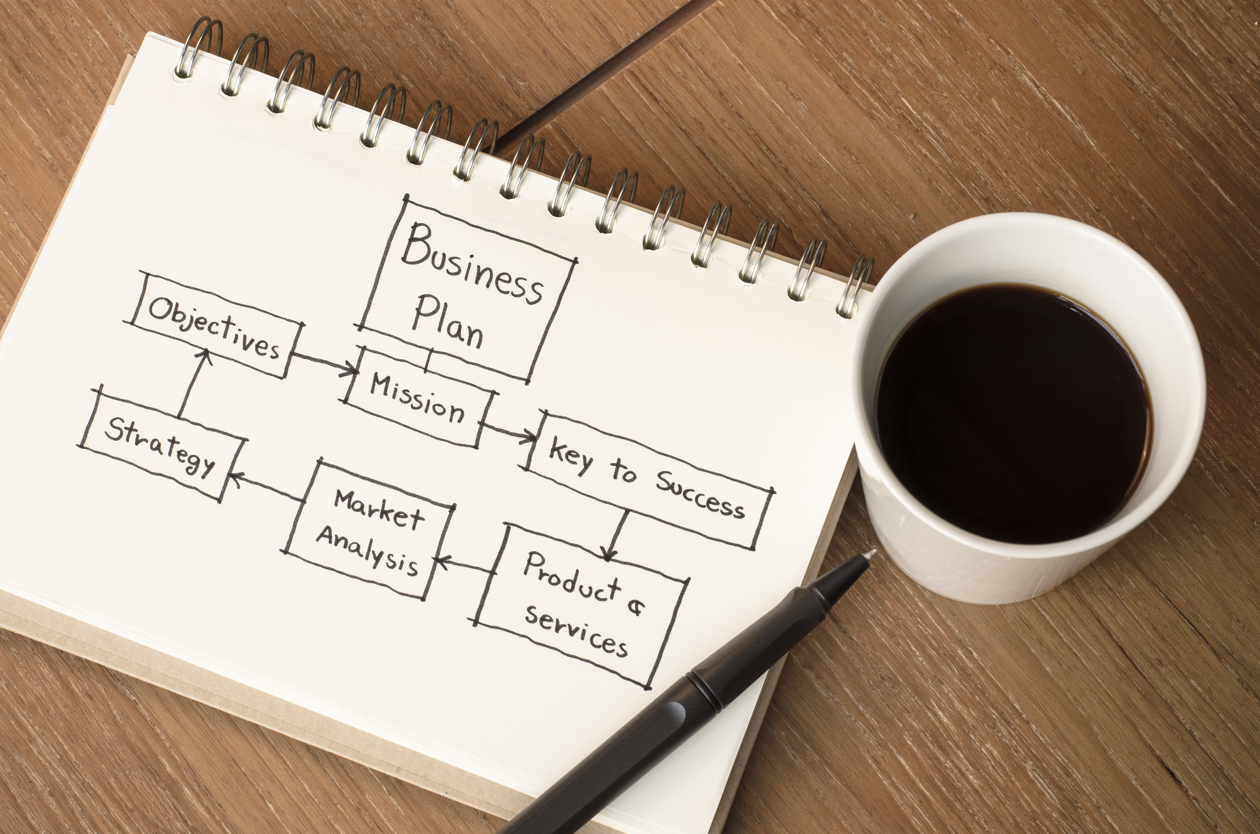

2. Types of Semi-Truck Financing

There are many different types of financing options available and understanding the different options allows you to choose one that is best aligned with your business goals.

Debt Financing: These are typically business loans and involve taking out a lump sum that you will repay over a set period with interest. Debt financing is suitable for purchasing a truck outright, giving you ownership from the start.

Equipment Financing: Tailored specifically for the purchase of business equipment, this type of financing allows you to spread the cost over time while using the equipment for your business operations. It is also more accessible than your typical bank loans.

Small Business Line of Credit: This is a more flexible financing option that is provided by the U.S. Small Business Administration to help small businesses get the funding they need to get started. There are a few different SBA loans available, depending on your business needs.

3. Choosing a Lender

Selecting the right lender is a critical decision that can significantly impact the terms of your financing; this can depend on your loan requirements, credit score, and repayment history.

Banks and Credit Unions: Traditional financial institutions often offer competitive interest rates and a range of loan products, such as commercial vehicle lending or small business loans. However, approval criteria may be strict, so you will need a good credit score among other qualifications.

Alternative Online Lenders: Online lenders have gained popularity for their quick and streamlined application processes, as well as their more flexible terms. While interest rates may be higher, the accessibility and speed of funding can be advantageous for those with lower credit scores.

Business Loan Brokers: These professionals have a large network of lenders that they can connect borrowers with. This saves you time from applying separately to these different lenders, streamlining the application process.

4. Check Your Qualifications

Before applying for a commercial truck loan, assess your qualifications to strengthen your loan application and the finance options that you qualify for.

Credit Score: A good credit score is key to securing favorable loan terms, preferably of 640 or higher. Regularly check your credit report for inaccuracies and work on improving your score if needed.

Business Revenue: Lenders will assess your business’s financial stability, so if you are looking to expand your business ensure your revenue and financial statements are in order. For those looking to get into the industry, demonstrating a steady income stream increases your chances of approval.

Payments: While some lenders offer no-money-down options, offering a substantial down payment can improve your loan terms. By saving up for a down payment, you can strengthen your position during negotiations.

Insurance: Comprehensive insurance coverage is often a requirement for getting financing for your vehicle. This can include primary liability coverage, cargo coverage, and physical damage coverage, amongst others. Research insurance options in advance to include accurate estimates in your budget.

5. Completing and Submitting the Application

Once all of these have been completed, it’s time to complete the loan application.

Personal and Business Information: Specific documentation requirements may depend on the lender, but most of them will require tax returns, financial statements, and personal identification. You should also provide accurate information about your business structure, years in operation, and the intended use of the truck.

Loan Amount and Terms: Specify the loan amount you’re requesting and the desired repayment terms. Other factors that you should mention include interest rates, monthly payments, and any additional fees associated with the loan.

Review and Submit: Carefully review your application before submitting it and ensure all information is accurate and complete; this will ensure that the loan process can be expedited.

Embarking on the journey of commercial truck ownership is exciting and understanding the key aspects of financing is very important for success. Before applying for a loan, it is important to do your research and get all your documents in order to ensure that the loan is approved as quickly as possible.