Trucking rates have fallen substantially, fuel prices are sky high and it takes considerably more time and effort to secure the highest-paying loads out there.

These statements are all true.

But believing them without gaining the proper perspective can get you in trouble in today’s freight market.

Perspective is everything. The stop-and-go traffic in front of you isn’t so bad when your GPS informs you that it’ll only last a quarter of a mile. There’s no need to do anything rash. So just chill and listen to your podcast.

Likewise, it’s important to keep today’s freight market in perspective. Otherwise you might make a rash decision or miss the opportunities right in front of you.

You’re Only in a Down Market if You Say So.

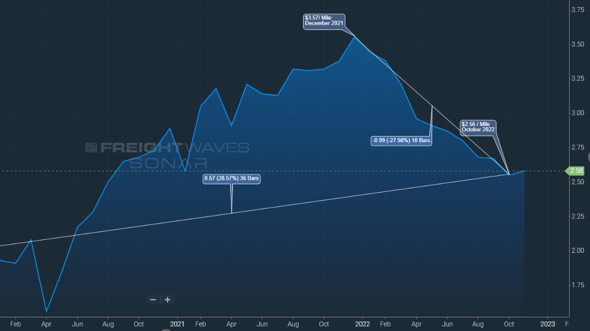

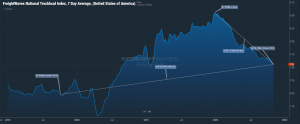

When you hear that rates are down 30%, remind yourself that was from December 2021 when rates were at a historic peak. $3.57 per mile and above was as good as it gets. We were spoiled. Our expectations have gotten out of whack.

If we reach back to 2018 and 2019 when most drivers and analysts would agree rates were pretty good, $2 was normal. Spot rates as of September 2022 have hovered around $2.65. For much of 2022, they’ve been 30% above what is considered normal or pretty good by historic standards.

Freight Volumes are Up from 2018-2019.

No doubt we’ve seen a dramatic decrease in freight volumes over the last year. They’ve dropped 30% as of October 11th, 2022, from their peak on August 22nd of 2021. Ouch, yes. But at the same time, we’re still higher than we were in the two years pre-COVID.

If you look at the volumes shown in the chart below, you’ll see volumes as of the 11th of October 2022 are 16% higher than they were at the same time in 2019, and they’re 18% higher than they were in 2018. The industry was generally happy, or as happy as truckers tend to get anyway, with 2018. If you look at the volume since then, there are ups and downs, but it’s pretty level all the way through until the uptick from COVID when volumes went through the roof.

The point to remember is that today’s volumes are still significantly above “normal” pre-COVID levels.

How Are Today’s High Fuel Prices Factoring in?

Considering that freight volumes are above 2018/2019 norms and rates are, too, shouldn’t we all be making money? Yes and no. The main reason for the no, is that fuel prices are 70% higher than they were in 2019.

The jump from the national average of $3.02 a gallon for diesel this time in 2019 to $5.15 as of October 11th, 2022, is having a significant impact on profitability—especially for owner-operators and small fleets. Billy Forkey, Manager at Trucker Path DISPATCH, explains that while large carriers with fuel charges built into their contracts are typically somewhat insulated from the impact of fuel hikes, owner-operators and small fleets aren’t. They’re booking loads off the load board or are working with brokers. It’s a one-time load and a one-time rate with everything built in and there’s no fuel surcharge broken out.

The lack of flexibility has added to the challenge of maintaining profitability in today’s market. Forkey says that “With the national average driving rate at right around $2.581 today, and most carriers cost per mile (CPM) floating right around $2.25 to $2.50 per mile, there’s just not a whole lot of room for profit there.”

Can You Make Money in Today’s Freight Market?

There’s money to be made, but it’s not from holding out for the rates of yesteryear or from discovering an overlooked and lucrative lane.

According to Forkey, powering through today’s diesel-fueled challenges and maintaining a healthy profit margin all comes down to managing your cost per mile.

“If you calculate in the 70% increase in fuel, we’re probably closer to that same profit margin as far as cost per mile versus rate per mile (RPM). And then your profit per miles is probably the same,” he says. “To clarify, margins today are like margins most trucking companies were experiencing in 2019. The average cost per mile is up around $.40 – $.50 with today’s fuel price and the RPM is up about $.50 -$.60 per mile. If you calculate the increased cost for parts, labor and maintenance, the profit margins are about the same.”

In other words, it is still possible to make money in today’s markets.

Where Are the Best Lanes and Rates?

Two fallacies that are sure to hurt drivers in today’s freight market are believing that there are magic lanes out there and if you just wait long enough, a nice, high pandemic-priced load will pop up on the load board.

Regarding the first fallacy, Forkey warns that there are no honey holes out there and the occasional super-high-paying loads are anomalies. With the exposure on load boards and competition today, rates are naturally evened out and the exceptional dollar figures are snapped up in minutes if they ever exist at all.

Believing fallacy number two—that it pays to hold out a few days for a high-paying load—can bleed a driver right out of business. “When a guy waits around for a good paying load and misses three or four days, his fixed costs don’t change. His insurance is still the same. His truck payment is still the same. If he’s paying his driver’s salary, that’s still the same. He may save on his variable costs like fuel and maintenance, but he’s losing money. He really needs to lower that cost per mile by just putting in more miles,” Forkey says.

The Importance of Knowing Cost Per Mile Today.

High cost per mile is the force that’s taking down many owner-operators and small fleets in today’s market. Many got into business as high rates peaked. A major problem is that many operating costs also peaked at the same time. Now with the drops in rates, lots of truckers are strained under the weight of big truck and trailer payments, costly insurance policies and a long list of often unforeseen expenses.

Knowing your costs, right down to estimated maintenance, depreciation, factoring fees and more is essential to surviving and thriving in today’s market.

The other key is understanding that while these costs are fixed, your ability to lower cost per mile isn’t. The truth is the more you drive, the lower your cost per mile.

Here’s how Forkey nutshells it: cost per mile depends upon how many miles you actually run. “If you run one mile on your truck and you have $1,000 a month cost, the cost per mile is a thousand bucks. But if you run 100 miles, it’s $10. And if you run 1000 miles, it’s $1.”

The winning strategy is asking how many miles you can get in—and then not being picky.

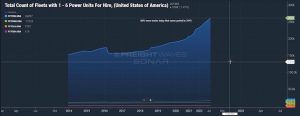

Overcapacity Is a Reality We All Must Face.

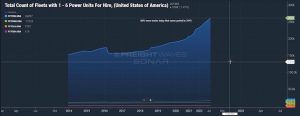

As long as we’re comparing 2018 and 2019 to today, it’s crucial to point out that there are considerably more trucks in the market now. 50% more than in 2018 and 40% more than 2019. Yes, volumes are up and rates are up since 2018-2019, but there are also more trucks competing for loads.

Many of those new trucks entered the market during the pandemic peak. For these and other owner-operators and small fleets it is a war of attrition fought on the battlefield of cost per mile. Industry publications are predicting a bloodbath, as many new entrants realize that the truck and trailer payments, insurance premiums, fuel costs and low rates are unsustainable, forcing them to leave the market.

Forkey believes that maintaining profit margin will be the main challenge in the immediate future, but that the market will correct itself. “It only gets worse before it gets better. And better times are around the corner, maybe a year out, but they’re there. They’re coming. They always do,” he says.

Strategies for Competing Amidst Today’s Overcapacity.

Success in the current environment comes down to two words: lane development.

Forkey describes it as a combination of building relationships and working the same lanes. In doing so, you can become an expert in that lane. Once you’ve proven yourself, you have an opportunity to push rates up. And once you become known to brokers or shippers in the lane, they start offering you freight.

“Really, all you can do is work on lane development and build relationships. Those are the only tools that you have in your bag in this market as a carrier—or get contracted freight. But it’s hard to get contracted freight with a 1 to 6 truck fleet,” he says.

With 135 freight markets2 across the U.S., most carriers are located close to a major trucking market that has enough volume to develop a lane. With market understanding and a commitment of time, it can be done.

It all hinges on a carrier’s understanding of their cost per mile.

For that reason, calculating cost per mile may be the greatest opportunity in trucking today. Get to work on yours. And if you have any questions, our dispatch service will be happy to help.

1. Freightwaves National Truckload Index, 7 Day Average

2. Freightwaves Tracked Markets