- For Drivers

- Truck Navigation for DriversSafe routing for commercial trucks

- Discounted Fuel DealsSave $50 - $70 every time you fuel at participating truck stops

- Fuel PricesSee current prices at fueling locations nationwide

- Over-the-Road MapDiscover trucking places-of-interest like truck stops and weigh stations

- Find LoadsTruckLoads from Trucker Path gives carriers free unlimited access to 150,000+ loads daily. Find available freight faster than ever.

- Driver CommunityReal-time, crowdsourced road intelligence

- MarketplaceBig savings on the products & services you need as a trucker

- For Fleets

- Truck Navigation for FleetsGive your drivers the app that helps make them more effecient, safe and productive

- Fleet ManagementAll-in-one trucking software for dispatching, navigation, workflows, and communication

- Fleet Fuel PaymentsManage your fleet fuel expenses, get discounted fuel and more with no credit required

- MarketplaceBig savings on the products & services trucking fleets need

- For Brokers

- Post FreightPost your loads to the largest pool of qualified carriers in North America

- Find CarriersDirectly source and build relationships with our carrier network

- Freight Market DataGet insights on data analytics including lane rates, capacity data, profit engine to grow your brokerage

- Trucker Path for BrokeragesDispatch loads directly to your carriers, track and share progress, and more

- Company

- Partners

- Fuel NetworkIncrease fuel and C-store sales from nearly 1 million Trucker Path users

- Integration PartnersUnlock greater supply chain efficiency with API integrations

- Local Business PartnersPut your business on Trucker Path and reach millions of drivers

- Advertise With UsSetup your digital billboard to drive traffic and increase conversions

- Ambassador ProgramApply to join our exclusive community of influencers over the road

For Drivers

Truck Navigation for Drivers

Safe routing for commercial trucks

Discounted Fuel Deals

Save $50 - $70 every time you fuel at participating truck stops

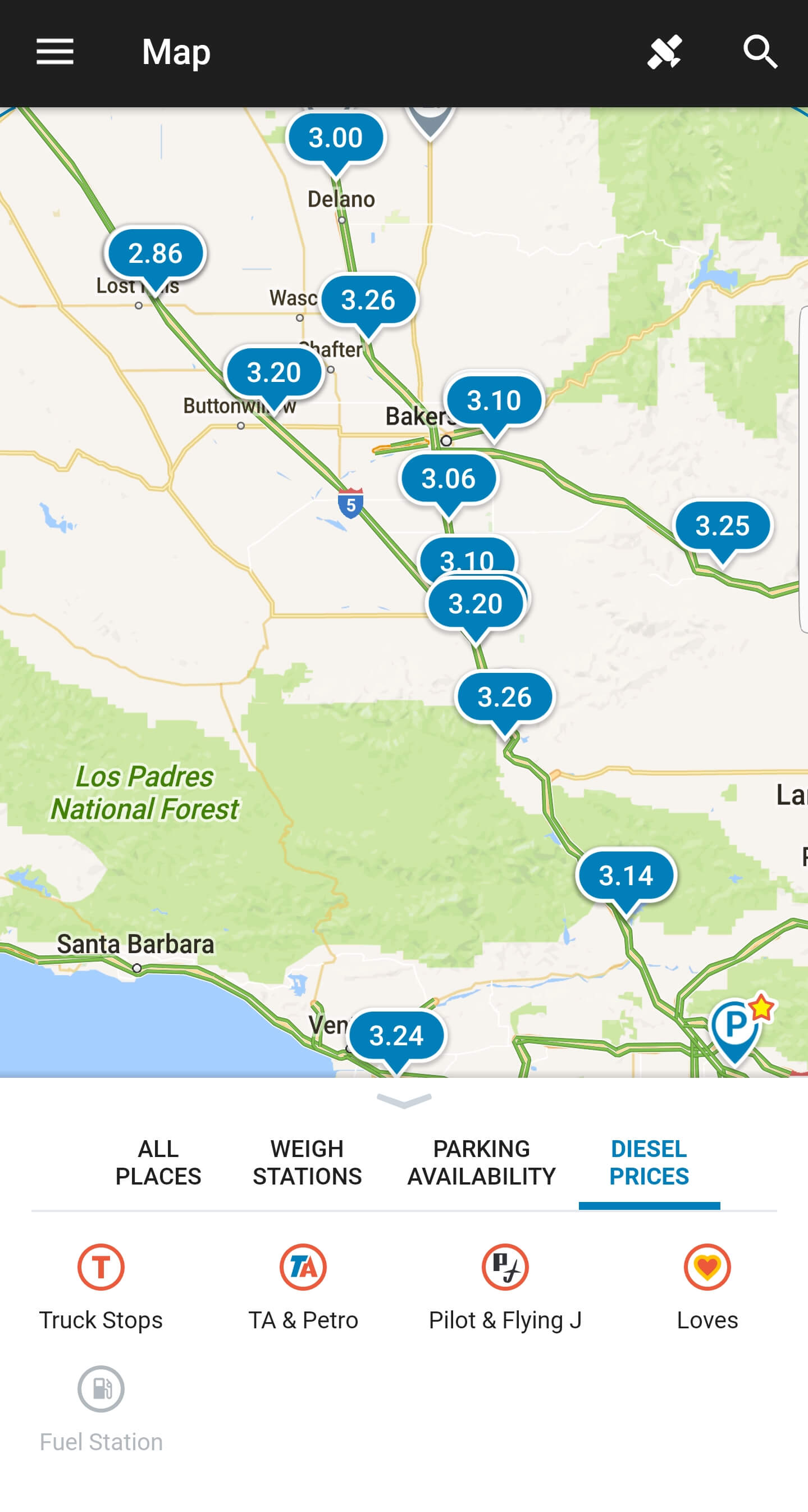

Fuel Prices

See current prices at fueling locations nationwide

Over-the-Road Map

Discover trucking places-of-interest like truck stops and weigh stations

Find Loads

TruckLoads from Trucker Path gives carriers free unlimited access to 150,000+ loads daily. Find available freight faster than ever.

Driver Community

Real-time, crowdsourced road intelligence

Marketplace

Big savings on the products & services you need as a trucker

For Fleets

Truck Navigation for Fleets

Give your drivers the app that helps make them more effecient, safe and productive

Fleet Management

All-in-one trucking software for dispatching, navigation, workflows, and communication

Fleet Fuel Payments

Manage your fleet fuel expenses, get discounted fuel and more with no credit required

Marketplace

Big savings on the products & services trucking fleets need

For Brokers

Post Freight

Post your loads to the largest pool of qualified carriers in North America

Find Carriers

Directly source and build relationships with our carrier network

Freight Market Data

Get insights on data analytics including lane rates, capacity data, profit engine to grow your brokerage

Trucker Path for Brokerages

Dispatch loads directly to your carriers, track and share progress, and more

Partners

Fuel Network

Increase fuel and C-store sales from nearly 1 million Trucker Path users

Integration Partners

Unlock greater supply chain efficiency with API integrations

Local Business Partners

Put your business on Trucker Path and reach millions of drivers

Advertise With Us

Setup your digital billboard to drive traffic and increase conversions

Ambassador Program

Apply to join our exclusive community of influencers over the road

Get a Demo

See how Trucker Path’s platform can scale up your trucking company

Are you a

Fleet Owner or Manager

Freight Broker

next